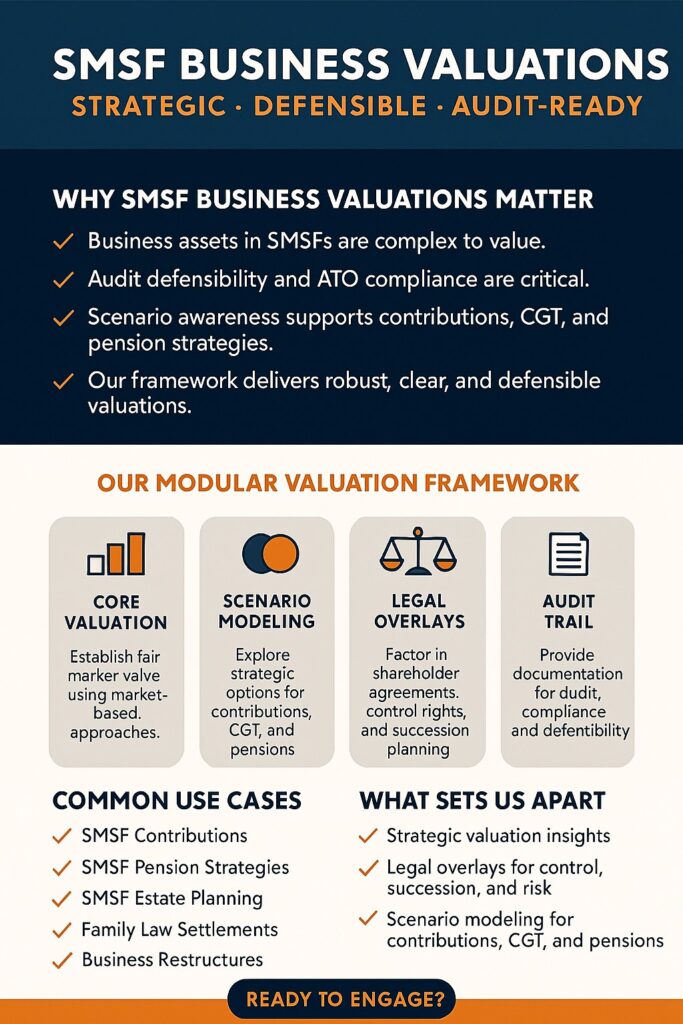

SMSF BUSINESS VALUATIONS

Strategic · Defensible · Audit-Ready

Business valuations for a Self-Managed Super Fund (SMSF) are crucial for ensuring compliance with regulatory requirements and for making informed investment decisions. Having your business valued for a Self-Managed Super Fund (SMSF) is essential for several reasons:

- Regulatory Compliance

The Australian Taxation Office (ATO) requires SMSFs to maintain accurate asset valuations to ensure compliance with superannuation laws.

- Asset Allocation

A clear valuation helps determine how much of the SMSF’s assets are tied up in the business, impacting investment strategies and risk management.

- Financial Reporting

Accurate valuations are necessary for preparing financial statements and meeting reporting requirements, ensuring transparency for members and auditors.

- Transaction Decisions

If you plan to sell, transfer, or change the structure of your business, a current valuation helps inform these decisions and supports fair pricing.

- Member Benefits

A fair valuation protects the interests of all SMSF members, ensuring equitable treatment and compliance with the fund’s governing rules.

- Investment Strategy

Understanding the value of your business allows for better investment planning and diversification within the SMSF.

- Estate Planning

In the event of a member’s passing, having a clear valuation simplifies the process of dividing assets and complying with estate laws.

- Audit Preparedness

Regular valuations can help prepare for audits, minimizing potential issues with compliance and governance.

- Transaction Readiness

Prepare for potential sales or transfers of business interests.

Our Approach

BRV applies rigorous valuation methodologies aligned with industry standards and ATO expectations. Our process includes:

- Market-Based Comparisons: Benchmarking against industry multiples.

- Income-Based Valuation: Using discounted cash flow (DCF) or capitalisation of earnings where appropriate.

- Asset-Based Valuation: For businesses with significant tangible assets or where earnings are volatile.

- Risk Adjustments: Incorporating business-specific risk premiums to reflect SMSF suitability.

We also normalise earnings to account for discretionary expenses, related party transactions, and non-commercial arrangements—ensuring the valuation reflects true market value.

The principle of BRV Lee Goldstein has been involved in Business Valuations and sale of Businesses since 1985. He holds a double major degree in Accounting and Finance, a Diploma in Forensic Accounting, a Graduate Diploma in Valuation (property), an Advanced Certificate of Business and an Advanced International Certificate in Intellectual Property. Lee has conducted numerous intellectual property valuations covering a diverse range of industries, and is often called upon to provide expert testimony in judicial matters. He has valued businesses and intellectual property worth over $3.2 billion.

Lee has also been the Triennial Certificate holder and Licensee of a Business Broking Company since 1992