Business Valuation for Change of Entity or Tax Purposes.

A Business Valuation for Change of Entity or Tax Purposes is needed for situations where you need to know the market value of a business, or intangible asset for shareholder or tax purposes.

The restructuring of a business from one type of entity to another (e.g. trust to private company) is a transaction, and often triggers certain taxation events (such as Capital Gains Tax). It is crucial to have Valuations for Regulatory Purposes in these instances.

Is your accountant about to restructure your business entities?

Are you taking on new partners, or selling your shareholding to an existing partner? If so then you will need a business valuation to report the market value of the business for tax and other reporting requirements.

Are you moving part or the whole of your business overseas? This may well trigger taxation events.

A Business valuation for change of entity may also be required for taxation requirements (capital gains tax concessions or ATO disputes), liquidations or going concerns.

The valuation of a business for tax purposes is usually based on a number of established valuation methods built around the market-based, income-based and asset-based approaches.

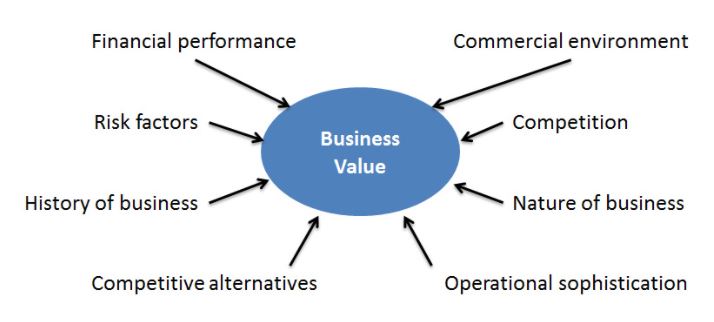

In valuing a business, there are a number of factors that may affect the market value and produce a reasonable and defensible view of the market value. It is important that a business valuation is transparent and any factors affecting the outcome have to be understood.

These factors may include:

Valuation Methods – choices need to be explained and demonstrated as to why they are appropriate

Valuation Metrics –for instance, a description of how a company weighted average cost of capital was derived.

Valuation Date

Purpose of the valuation

Basis or premise of your valuation – for example, valuation of the business on a going-concern basis

Description of the business.

Valuing intangible assets and intellectual property

The valuation of intangible assets, including intellectual property but excluding goodwill, is based on a number of established valuation methods using market-based, income-based, cost-based and probabilistic approaches.

It is very important to apply the correct methods in the context of existing legislation, ATO practice (such as rulings) and established industry approaches.

One thing is paramount in Business Valuation, and that is that the valuer has the experience and qualifications to provide a valuation that is accepted for taxation, merger and acquisition or litigation purposes.

If you require a Business Valuation for Change of Entity or Tax Purposes, contact Lee Goldstein at brv.com.au on 1800 566 872